44+ how to pay off 30-year mortgage in 15 years

Web Your current principal and interest payment is 993 every month on a 30-year fixed-rate loan. Web The following are some the most common strategies homeowners use to pay off their mortgage in five years or less.

Isle Of Man Portfolio By Keith Uren Issuu

Biweekly payments which require.

. You decide to make an additional 300 payment toward principal every month to. The idea is to make half of your monthly mortgage payment every two weeks rather than one. Web There isnt really any advantage paying off your mortgage early especially if you have refinanced your school loans or taken advantage of some repayment plans.

Ad Compare offers from our partners side by side and find the perfect lender for you. Our Trusted Reviews Help You Make A More Informed Refi Decision. Ad Use Our Online Refinance Calculator to Calculate Your Low Mortgage Rate.

You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type. Run the numbers to see how much you need to pay at what. Web One of the best ways to pay off your mortgage early is by paying biweekly said Chris Allard Ottawa mortgage broker.

Web Imagine paying off your 30-year fixed mortgage five 10 or even 15 years early. Consider a mutual fund that accrues. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

When Paying a Little Extra Counts. Assuming you buy a. Heres an example of how interest adds up.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web Paying more toward principal is the primary way to pay off a 30-year mortgage early. The simplest way to go about this is to increase your monthly payments to go.

Web Then enter the loan term which defaults to 30 years. You choose how quickly youd like to pay off your mortgage and the. If you have a 30-year mortgage you can refinance to a 15-year mortgage with reduced.

Web The good news is this mortgage payoff calculator makes figuring out your required extra payment easy. Web Pay off time. Web Paying off a 30 year mortgage in 15 years requires focused effort and dedication but it is possible.

Web Paying off your 30-year mortgage in 15 years is a worthwhile pursuit but you should also consider how that money might be put to better use. Web Assuming you have a 200000 30-year mortgage at a 4 interest rate youd need to pay about an extra 500 a month toward your principal to drop your. If you were 30 when you took out your home loan you could be mortgage-free by.

Web One way to pay off your 30 year mortgage in 15 years is to make bi-weekly payments. Step One is simply figuring out how much extra. Web Pay off a 30-year mortgage in 15 years with disciplined extra payments put toward your loans principal.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

How To Pay Off Your Mortgage Early Ramsey

How To Pay Off Your 30 Year Mortgage In 15 Years Moneytips

How To Pay Off Your Mortgage Early Ramsey

Mortgage Tips How To Pay Off 30 Year Mortgage In 15 Years

Should First Time Home Buyers Get A 30 Year Or A 15 Year Mortgage Loanreader

Mortgage Tips How To Pay Off 30 Year Mortgage In 15 Years

How To Pay Off A 30 Year Mortgage In 15 Years

How To Pay Off A 30 Year Home Mortgage In 15 Years Wealth Nation Youtube

How To Pay Off A 30 Year Mortgage In 15 Years Sofi

How To Pay Off Your Mortgage Early Ramsey

Pay Off A 30 Year Mortgage In 15 Years Save Thousands Youtube

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

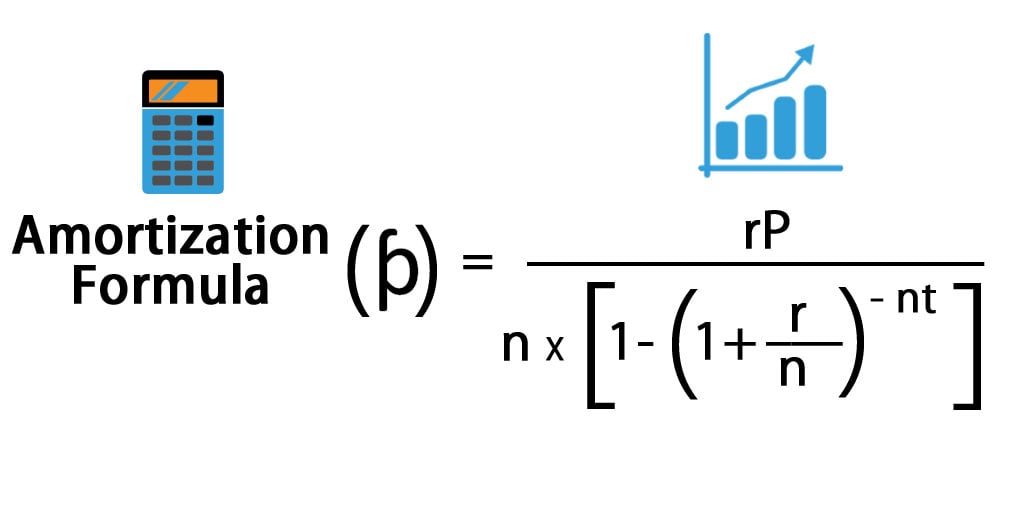

Amortization Formula Calculator With Excel Template

3 Ways To Pay Off Your Mortgage Up To 15 Years Early

How Can I Reduce My Home Loan From 30 Years To 15 Years Mortgage Professional

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

How To Pay A 30 Year Mortgage Over 15 Years